-

Welcome to the WDWMAGIC.COM Forums!

Please take a look around, and feel free to sign up and join the community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Disney’s Q4 FY18 Earnings Results Webcast

- Thread starter MisterPenguin

- Start date

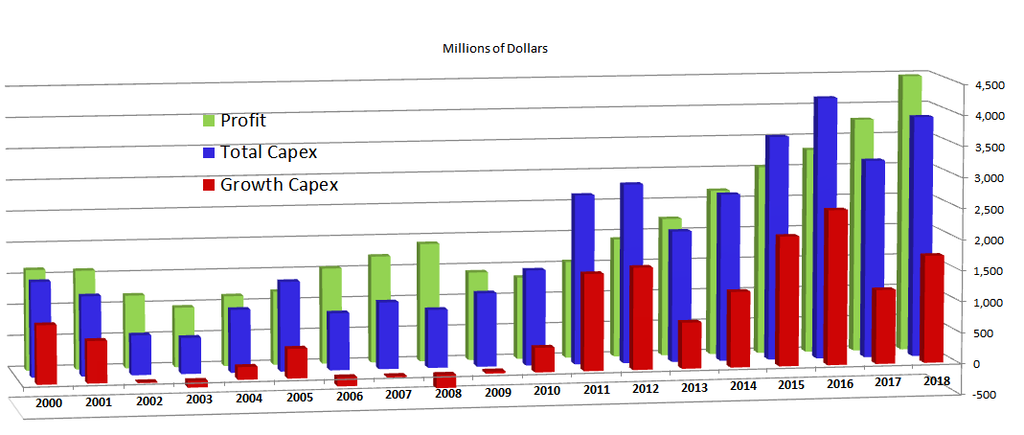

Capital Expenditures

- Profit is operating revenue minus operating expenses.

- Total Capex is investment in parks and resorts worldwide. Five times as much capex in 2018 went domestically than internationally ($3.2 billion v. $.67 billion), but I believe domestic includes cruise lines.

- Growth Capex is total capex minus depreciation which gives one an idea how much was spend on new stuff rather than repairing/replacing old stuff.

winstongator

Well-Known Member

Better than I expected. I still want to see the attendance and per guest spending growth numbers they put in the full annual report.

How was disneyland’s Attendance the past few months?

How was disneyland’s Attendance the past few months?

Summary of Webcast...

Finalizing Fox acquisition looks to happen a lot sooner than originally thought (which was June of 2019).

1 mil users of ESPN+

Disney+ to launch late 2019

Docu-Series to come to D+, such as one on Imagineering

Movie Studio $3B revenue record

Domestic P&R:

Media Networks

No stock buybacks in 4Q

New Corporate Structure

Investor Day in April to preview DTC and Fox acq.

Don’t panic:

QA

Hulu will get more original programming from Disney and Fox TV production companies

Hulu’s demo is great, 20 years younger, good for advertisers

Hulu’s programming is called ‘general entertainment programming’, D+ gets ‘family programming’

Hulu: looking for more plasticity on service tiers, squeezing more profit from it

Not going to cut ‘theatrical windows’ to enhance the ‘TV window’ or the ‘digital window’

Plan to put D+ and Hulu in international markets even without Sky.

Shanghai had soft attendance due to a general softness in economy and tourism. So, they give out discounts, which are now discontinued.

Is Star Wars Land going to be as big as Cars Land or Pandora? It will be huge. Managing the crowds will be a challenge, but a good one to have. And WRT DHS, we want that park to have big growth.

ESPN+… plan to target alumni of colleges whose games they carry

Pass on answering question about how exclusive will Disney IP be to all it's DDT streams.

Current channels aren't planned to be discontinued at this point. But, if an entertainment source isn't profitable.....

Finalizing Fox acquisition looks to happen a lot sooner than originally thought (which was June of 2019).

1 mil users of ESPN+

Disney+ to launch late 2019

Docu-Series to come to D+, such as one on Imagineering

Movie Studio $3B revenue record

Domestic P&R:

- Attendance at domestic parks up 4% (remember that when TEA's numbers come out in April)

- per capita spending up 9%

- per room spending up 8%

- occupancy: 85%, up 1% from last year

- reservations up 3% this quarter

- booked rates up 4% this quarter

Media Networks

- cable down, broadcast up

- rate of cable subscriber loss has declined each quarter for five quarters

No stock buybacks in 4Q

New Corporate Structure

- Media Networks

- Parks Experiences & Consumer Products

- Studio Entertainment

- Direct to Consumer & International

Investor Day in April to preview DTC and Fox acq.

Don’t panic:

- Q1 2019 Studios will be way down in comparison because of all the blockbusters last year

- Next year cable costs will be up due to existing contracts and timing of certain sports

- Ramping up Disney+ will incur big expenses

QA

Hulu will get more original programming from Disney and Fox TV production companies

Hulu’s demo is great, 20 years younger, good for advertisers

Hulu’s programming is called ‘general entertainment programming’, D+ gets ‘family programming’

Hulu: looking for more plasticity on service tiers, squeezing more profit from it

Not going to cut ‘theatrical windows’ to enhance the ‘TV window’ or the ‘digital window’

Plan to put D+ and Hulu in international markets even without Sky.

Shanghai had soft attendance due to a general softness in economy and tourism. So, they give out discounts, which are now discontinued.

Is Star Wars Land going to be as big as Cars Land or Pandora? It will be huge. Managing the crowds will be a challenge, but a good one to have. And WRT DHS, we want that park to have big growth.

ESPN+… plan to target alumni of colleges whose games they carry

Pass on answering question about how exclusive will Disney IP be to all it's DDT streams.

Current channels aren't planned to be discontinued at this point. But, if an entertainment source isn't profitable.....

MickeyMinnieMom

Well-Known Member

So the sky STILL isn’t falling?!? How weird...Summary of Webcast...

Finalizing Fox acquisition looks to happen a lot sooner than originally thought (which was June of 2019).

1 mil users of ESPN+

Disney+ to launch late 2019

Docu-Series to come to D+, such as one on Imagineering

Movie Studio $3B revenue record

Domestic P&R:

- Attendance at domestic parks up 4% (remember that when TEA's numbers come out in April)

- per capita spending up 9%

- per room spending up 8%

- occupancy: 85%, up 1% from last year

- reservations up 3% this quarter

- booked rates up 4% this quarter

Media Networks

- cable down, broadcast up

- rate of cable subscriber loss has declined each quarter for five quarters

No stock buybacks in 4Q

New Corporate Structure

- Media Networks

- Parks Experiences & Consumer Products

- Studio Entertainment

- Direct to Consumer & International

Investor Day in April to preview DTC and Fox acq.

Don’t panic:

- Q1 2019 Studios will be way down in comparison because of all the blockbusters last year

- Next year cable costs will be up due to existing contracts and timing of certain sports

- Ramping up Disney+ will incur big expenses

QA

Hulu will get more original programming from Disney and Fox TV production companies

Hulu’s demo is great, 20 years younger, good for advertisers

Hulu’s programming is called ‘general entertainment programming’, D+ gets ‘family programming’

Hulu: looking for more plasticity on service tiers, squeezing more profit from it

Not going to cut ‘theatrical windows’ to enhance the ‘TV window’ or the ‘digital window’

Plan to put D+ and Hulu in international markets even without Sky.

Shanghai had soft attendance due to a general softness in economy and tourism. So, they give out discounts, which are now discontinued.

Is Star Wars Land going to be as big as Cars Land or Pandora? It will be huge. Managing the crowds will be a challenge, but a good one to have. And WRT DHS, we want that park to have big growth.

ESPN+… plan to target alumni of colleges whose games they carry

Pass on answering question about how exclusive will Disney IP be to all it's DDT streams.

Current channels aren't planned to be discontinued at this point. But, if an entertainment source isn't profitable.....

I wondered all along if the issue was that attendance wasn't falling, but just not up as much as they wanted.So the sky STILL isn’t falling?!? How weird...

I wonder if they'll reverse some of those recent cuts. OK, don't answer that.

winstongator

Well-Known Member

4% domestic attendance growth is more than last year and the most since 2015, although well short of that. 1.04*1.09 > 1.07*1.04 from 2015. Calculus of attendance*spending is tilting to increased spending.

Per touringplans assessments, crowds were way down from last year for July-Oct. With Disney's own assessment of softening attendance during that period, I'm not sure what to make of it.

How was attendance at DL & DCA?

Per touringplans assessments, crowds were way down from last year for July-Oct. With Disney's own assessment of softening attendance during that period, I'm not sure what to make of it.

How was attendance at DL & DCA?

I wondered all along if the issue was that attendance wasn't falling, but just not up as much as they wanted.

Last September 2017 was strong and not as off-peak as usual.

This September of 2018 was very weak and more off-peak than usual. Comparing 4Q revenue to the other quarters, it was less. Think about that... the summer quarter was the weakest. So, they panicked. Attendance right now seems strong with no signs of weakness.

So are they reversing some of the cost cuts they made when they panicked?Last September 2017 was strong and not as off-peak as usual.

This September of 2018 was very weak and more off-peak than usual. Comparing 4Q revenue to the other quarters, it was less. Think about that... the summer quarter was the weakest. So, they panicked. Attendance right now seems strong with no signs of weakness.

So are they reversing some of the cost cuts they made when they panicked?

Not sure, but the cuts don't seem to be as deep as they were made out to be. Citizens of Sunset may have been reduced, but, they're still performing. There's still a boatload of streetmosphere performers everywhere even though a few acts were cut. The Star Wars stage show is still supposed to come back after the concrete work is done. Planet Watch is supposed to come back in 2019. A boatload of extra stuff was added for Mickey's 90th. The one significant cut now unfortunately seems to be permanent: no more shaman for RoL.

MickeyMinnieMom

Well-Known Member

As per usual.Not sure, but the cuts don't seem to be as deep as they were made out to be.

As per usual.

I still mourn the Jawas...

winstongator

Well-Known Member

I still mourn the Jawas...

Last September 2017 was strong and not as off-peak as usual.

This September of 2018 was very weak and more off-peak than usual. Comparing 4Q revenue to the other quarters, it was less. Think about that... the summer quarter was the weakest. So, they panicked. Attendance right now seems strong with no signs of weakness.

I wondered all along if the issue was that attendance wasn't falling, but just not up as much as they wanted.

Everything is based on guidance and forecasting. In order to meet analysts expectation for earnings, each division has a target growth rate that needs to be met. (Yes isn't quarterly reporting wonderful). As @MisterPenguin said, the last quarter some parts of P&R seemingly underperformed based on expectations. (Even with TSL at DHS) So, they were growing, just not at the level they were forecasting.

ThatMouse

Well-Known Member

This just tells me the $200/night moderate rates are here to stay, and the $200/night deluxes are long gone.  Unless maybe it's everyone trying to get their last vacation in before parking fees start? Stop paying so much for your rooms people; you're just encouraging them! lol!

Unless maybe it's everyone trying to get their last vacation in before parking fees start? Stop paying so much for your rooms people; you're just encouraging them! lol!

winstongator

Well-Known Member

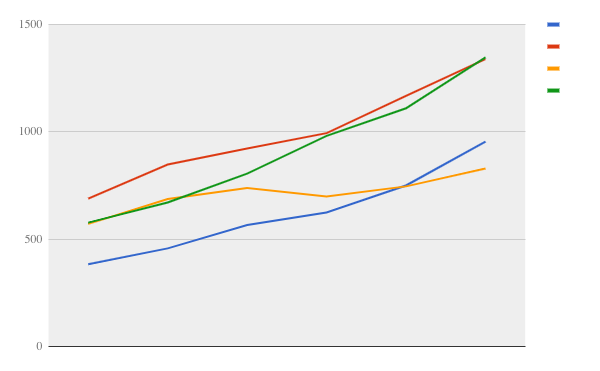

Quarterly results graph - one of these is less like the others. It's amazing how the red and green line up. Blue is Q2, Red Q3, Green Q1, yellow is the "middling" Q4. Looking at a quarter from year to year is a form of seasonal adjustment. I'll see if I can add in a few prior years.

Graph below is quarterly earnings for the parks & resort segment from 2013-2018. Q1-q3 have grown between 14-20% annually, while Q4 (summer) has grown at 8%. Most of that growth was in 2014, and since then Q4 has grown at less than 5%/yr.

2013-2018

Graph below is quarterly earnings for the parks & resort segment from 2013-2018. Q1-q3 have grown between 14-20% annually, while Q4 (summer) has grown at 8%. Most of that growth was in 2014, and since then Q4 has grown at less than 5%/yr.

2013-2018

Last edited:

Kevin_W

Well-Known Member

Quarterly results graph - one of these is less like the others. It's amazing how the red and green line up. Blue is Q2, Red Q3, Green Q1, yellow is the middling Q4. Looking at a quarter from year to year is a form of seasonal adjustment. I'll see if I can add in a few prior years.

Sorry, what is that a graph of?

winstongator

Well-Known Member

I'll edit the post - quarterly earnings for the parks & resorts segment by year. The 4 lines are the different quarters. The summer quarter where there was 'soft attendance' has been the slowest growing over the past 5 years.Sorry, what is that a graph of?

Transcript of the call now available: https://www.thewaltdisneycompany.com/wp-content/uploads/2018/11/q4-fy18-earnings-transcript.pdf

Register on WDWMAGIC. This sidebar will go away, and you'll see fewer ads.