-

Welcome to the WDWMAGIC.COM Forums!

Please take a look around, and feel free to sign up and join the community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Disney’s Q3 FY22 Earnings Results Webcast

- Thread starter DCBaker

- Start date

CaptainAmerica

Well-Known Member

Earnings are out.

EPS $1.09 vs. $0.96 expected BEAT

Revenue $21.5 billion vs $21.0 billion expected BEAT

EPS $1.09 vs. $0.96 expected BEAT

Revenue $21.5 billion vs $21.0 billion expected BEAT

Docs are live -

https://thewaltdisneycompany.com/app/uploads/2022/08/q3-fy22-earnings.pdf

“We had an excellent quarter, with our world-class creative and business teams powering outstanding performance at our domestic theme parks, big increases in live-sports viewership, and significant subscriber growth at our streaming services. With 14.4 million Disney+ subscribers added in the fiscal third quarter, we now have 221 million total subscriptions across our streaming offerings,” said Bob Chapek, Chief Executive Officer, The Walt Disney Company. “We continue to transform entertainment as we near our second century, with compelling new storytelling across our many platforms and unique immersive physical experiences that exceed guest expectations, all of which are reflected in our strong operating results this quarter.”

Disney Parks, Experiences and Products

Disney Parks, Experiences and Products revenues for the quarter increased to $7.4 billion compared to $4.3 billion in the prior-year quarter. Segment operating income increased $1.8 billion to $2.2 billion compared to $0.4 billion in the prior-year quarter. Higher operating results for the quarter reflected increases at domestic parks and experiences and, to a lesser extent, at international parks and resorts.

Operating income growth at our domestic parks and experiences was due to higher volumes and increased guest spending, partially offset by higher costs. Higher volumes were due to increases in attendance, occupied room nights and cruise ship sailings. Cruise ships were operating during the entire current quarter while sailings were suspended in the prior-year quarter. Guest spending growth was due to an increase in average per capita ticket revenue and higher average daily hotel room rates. The increase in average per capita ticket revenue was due to the introduction of Genie+ and Lightning Lane in the first quarter of the current fiscal year and a reduced impact from promotions at Walt Disney World Resort, partially offset by an unfavorable attendance mix at Disneyland Resort. Higher costs were primarily due to volume growth, cost inflation and new guest offerings. Our domestic parks and resorts were open for the entire current quarter, whereas Disneyland Resort was open for 65 days of the prior-year quarter, and Walt Disney World Resort operated at reduced capacity in the prior-year quarter.

Improved results at our international parks and resorts were primarily due to growth at Disneyland Paris, partially offset by a decrease at Shanghai Disney Resort. Higher operating results at Disneyland Paris were due to increases in attendance and occupied room nights, partially offset by higher operating costs due to volume growth. Disneyland Paris was open for the entire current quarter compared to 19 days in the prior-year quarter. The decrease at Shanghai Disney Resort was due to the park being open for all of the prior-year quarter but only for 3 days in the current quarter.

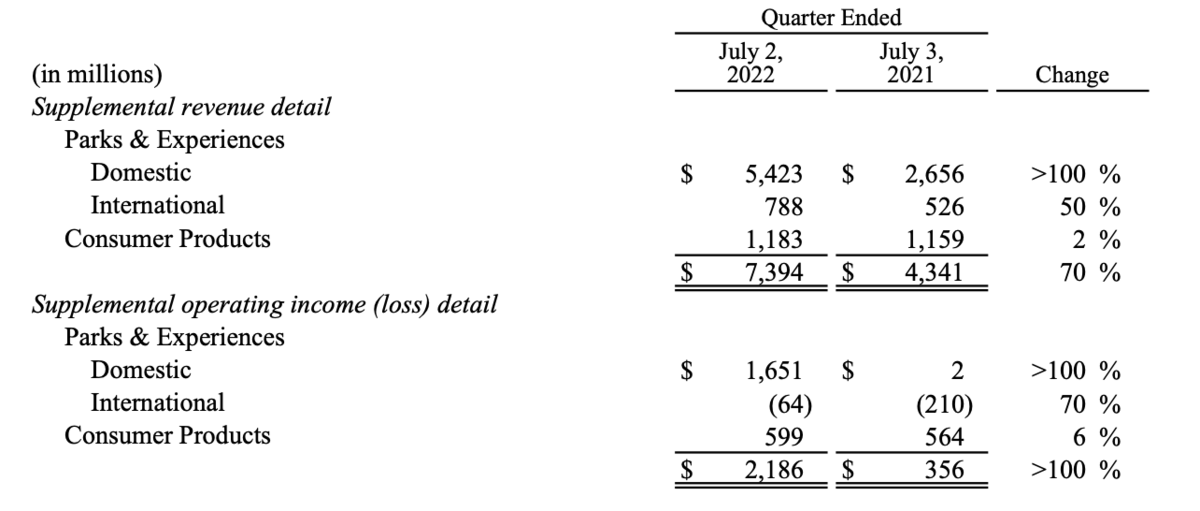

The following table presents supplemental revenue and operating income (loss) detail for the Disney Parks, Experiences and Products segment:

https://thewaltdisneycompany.com/app/uploads/2022/08/q3-fy22-earnings.pdf

“We had an excellent quarter, with our world-class creative and business teams powering outstanding performance at our domestic theme parks, big increases in live-sports viewership, and significant subscriber growth at our streaming services. With 14.4 million Disney+ subscribers added in the fiscal third quarter, we now have 221 million total subscriptions across our streaming offerings,” said Bob Chapek, Chief Executive Officer, The Walt Disney Company. “We continue to transform entertainment as we near our second century, with compelling new storytelling across our many platforms and unique immersive physical experiences that exceed guest expectations, all of which are reflected in our strong operating results this quarter.”

Disney Parks, Experiences and Products

Disney Parks, Experiences and Products revenues for the quarter increased to $7.4 billion compared to $4.3 billion in the prior-year quarter. Segment operating income increased $1.8 billion to $2.2 billion compared to $0.4 billion in the prior-year quarter. Higher operating results for the quarter reflected increases at domestic parks and experiences and, to a lesser extent, at international parks and resorts.

Operating income growth at our domestic parks and experiences was due to higher volumes and increased guest spending, partially offset by higher costs. Higher volumes were due to increases in attendance, occupied room nights and cruise ship sailings. Cruise ships were operating during the entire current quarter while sailings were suspended in the prior-year quarter. Guest spending growth was due to an increase in average per capita ticket revenue and higher average daily hotel room rates. The increase in average per capita ticket revenue was due to the introduction of Genie+ and Lightning Lane in the first quarter of the current fiscal year and a reduced impact from promotions at Walt Disney World Resort, partially offset by an unfavorable attendance mix at Disneyland Resort. Higher costs were primarily due to volume growth, cost inflation and new guest offerings. Our domestic parks and resorts were open for the entire current quarter, whereas Disneyland Resort was open for 65 days of the prior-year quarter, and Walt Disney World Resort operated at reduced capacity in the prior-year quarter.

Improved results at our international parks and resorts were primarily due to growth at Disneyland Paris, partially offset by a decrease at Shanghai Disney Resort. Higher operating results at Disneyland Paris were due to increases in attendance and occupied room nights, partially offset by higher operating costs due to volume growth. Disneyland Paris was open for the entire current quarter compared to 19 days in the prior-year quarter. The decrease at Shanghai Disney Resort was due to the park being open for all of the prior-year quarter but only for 3 days in the current quarter.

The following table presents supplemental revenue and operating income (loss) detail for the Disney Parks, Experiences and Products segment:

CaptainAmerica

Well-Known Member

Disney+ (no ads) to $10.99 per month

Disney+ (ad supported) to $7.99 per month

Disney+/Hulu/ESPN+ with no ads bundle no price change.

Disney+ (ad supported) to $7.99 per month

Disney+/Hulu/ESPN+ with no ads bundle no price change.

Slpy3270

Well-Known Member

Lucky me.Disney+/Hulu/ESPN+ with no ads bundle no price change.

Here is the direct link to listen to the earnings call -

CaptainAmerica

Well-Known Member

I've been beating the drum that Disney getting pummeled for Netflix losing subs is entirely unfair. Netflix isn't losing subs because streaming is dying, Netflix is losing subs because Netflix sucks.

GhostHost1000

Premium Member

Good so this means a 5th park right? Lol

CaptainAmerica

Well-Known Member

More Disney, More Relevant, More Timeless, and More FamilyGood so this means a 5th park right? Lol

Clamman73

Well-Known Member

A Journey refurbGood so this means a 5th park right? Lol

CaptainAmerica

Well-Known Member

They want everyone to switch to the Bundle because a Bundle subscriber counts as 3.Thats quite a price hike on D+. I guess they want everyone to switch to the Ad supported plan because they'll make more.

Kamikaze

Well-Known Member

Eh. Hulu sucks.They want everyone to switch to the Bundle because a Bundle subscriber counts as 3.

This Is Me, sung by DCappella, from Disney's Pride Celebration

Beyond the Great Plains from Prey, now on Hulu

Beyond the Great Plains from Prey, now on Hulu

the_rich

Well-Known Member

They have some good showsEh. Hulu sucks.

No Woman, No Cry, from upcoming Black Panther 2 movie.

ctrlaltdel

Well-Known Member

Hulu has a great TV show library.Eh. Hulu sucks.

Kamikaze

Well-Known Member

Prey and that's it.They have some good shows

Nothing I don't have elsewhere.Hulu has a great TV show library.

Register on WDWMAGIC. This sidebar will go away, and you'll see fewer ads.